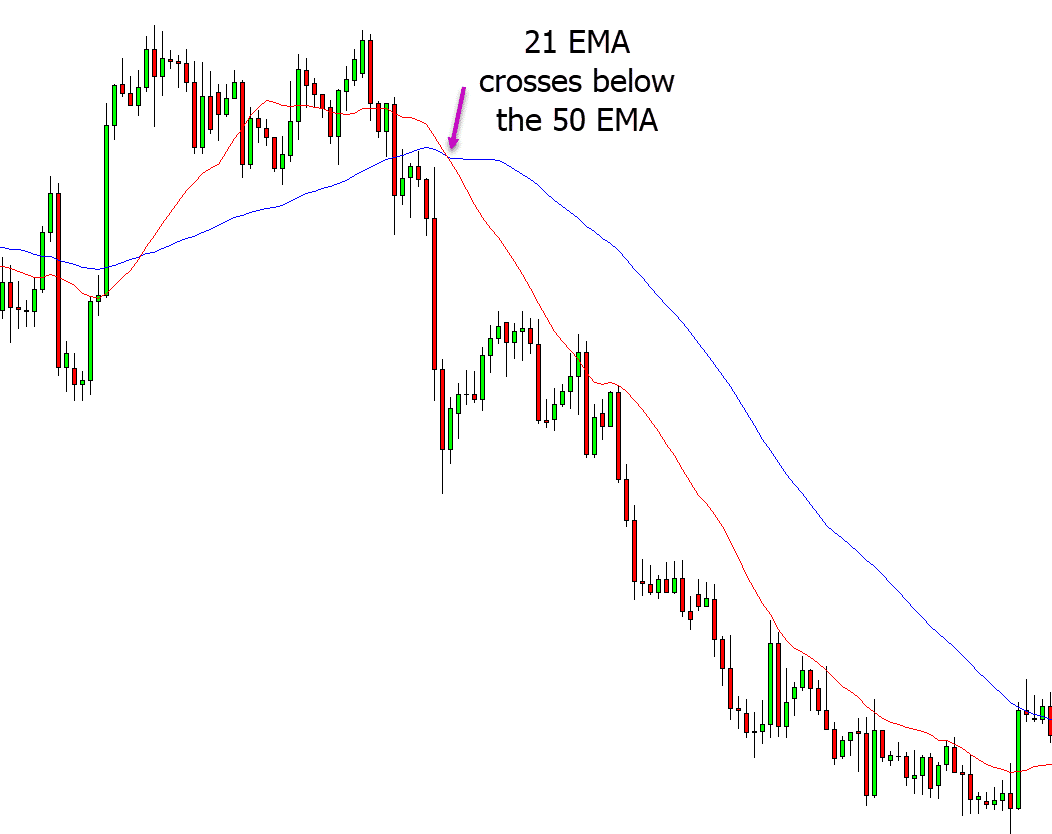

This could indicate a downtrend.Ī trader may choose to only take trades in stocks (or other assets) that are above a certain moving average.

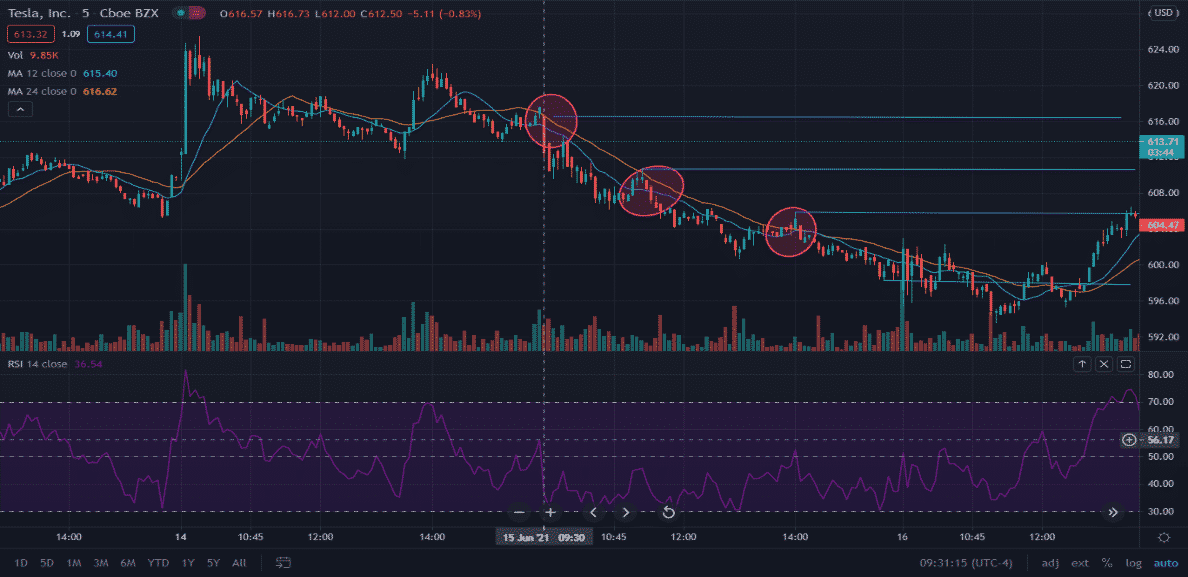

If the price is below the MA, it tells us the current price is below average. If the price is above the MA, it tells us the current price is above average. That said, trading strategies can be created using moving averages, and MAs can be valuable analysis tools. Since it is using historical data and is not predictive, it is referred to as a “lagging” indicator. It reacts to prices, it doesn’t forecast them. There is nothing inherently predictive about a moving average. While these particular number of period are popular, traders and investors can use any number of periods they want: 60, 350, 26, or 113, for example. Some traders use moving averages in combination with each other.įor example, they may use a 200 and a 50-period, or a 100 and 20, or a 200, 100, and 50. The following chart shows how the 200-day does a decent job of highlighting the overall direction of the stock. There are approximately 250 trading days in a year so this average encompasses close to a year’s worth of trading days. It is a slow-moving average that many traders view as important for signaling long-term direction changes. 200-period MA highlights long-term trends.It then undercut the 100-day and the price stayed below it for several months. On the chart above, MSFT stayed above the 100-day for almost an entire year as it rallied higher. 100-period MA captures longer-term trends.If the price is moving higher, small pullbacks will stay above the 50-period moving average. 50-period MA often highlights medium-term trends.They highlight the short-term trend direction. See the chart above from June to September, for example. 10- to 20-period MAs will show support for strongly rising prices or resistance for strongly falling prices.Here is a basic summary of what moving averages of various lengths are used for: How many periods to use is a personal choice based on what you want to accomplish with the moving averages. Since it is slower to react to price changes, the price can also move further away from it, while the shorter-term average sticks closer to the price. It tends to be “smoother” with less ups and downs. Therefore, the longer average reacts slower to price changes. Compare this to the 100-period average, and the last few data points don’t have much impact at all. This is because the most recent price input has a bigger impact when only a few periods are being averaged. It changes direction relatively quickly when the asset price changes direction. The shorter average tracks the price more closely. The chart above compares a shorter average (20) with a longer average (100).

How Many Periods to Use in a Moving Average If it was a 1-minute chart, these would be 20- and 100-minute averages. Since the time frame of the chart is daily, these are 20- and 100-day averages. The following chart shows a 20-period and 100-period moving average applied to it. Moving averages often use closing prices for whatever time frame is being used (1-minute, hourly, daily, or weekly chart), but the open, high, low, or average of these periods could also be used to generate the data points needed for the moving average. These values are connected on a chart to form a continuous line like the examples below.

If it was a 100-period moving average, we would need 100 closing prices before we could create the first average. Note how the simple moving average only uses the last 5 values, since this is a 5-period moving average. How a Moving Average is ConstructedĪ simple moving average is calculated by adding up the closing prices over a number of periods, and then dividing the total by the number of periods used.Ī period can be any time frame, such as 1-minute candles or daily candles/periods.Īssume a stock had the following closing prices and someone wanted to know the 5-period moving average: Closing Price Popular moving averages types include simple (SMA), exponential (EMA), and weighted moving averages (WMA).Īverages over 10 periods, 20/21, 50, 100, and 200 periods tend to be popular choices among traders. This article looks at ways moving averages are used and their benefits and drawbacks.Ī moving average is plotted on the chart and shows the average price of the asset over a given period. Like any tool, it is how it is used that determines its usefulness. Moving averages are a tool used by traders and investors for making trading decisions and analyzing price charts.

0 kommentar(er)

0 kommentar(er)